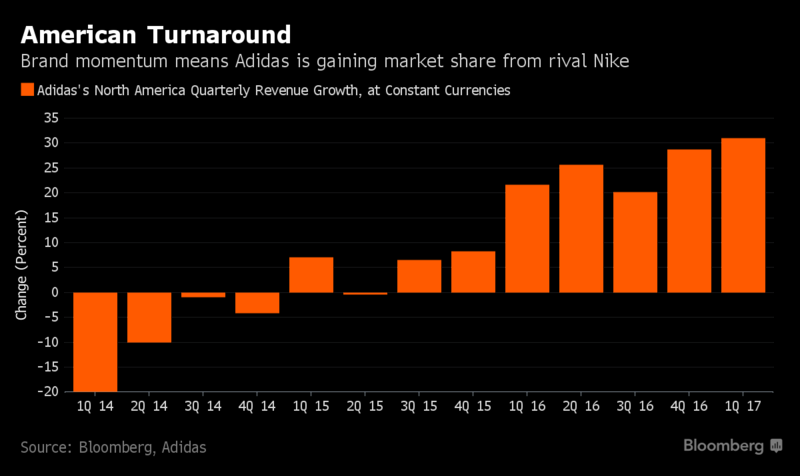

Adidas AG is racing ahead in the U.S. with sales growth that’s outstripping archrival Nike Inc. as its namesake brand and Reebok capitalize on the trend for retro and “athleisure” fashions that are worn off the sporting grounds.

North America was the German company’s strongest-performing region in the first quarter, with a sales increase of 31 percent at constant currencies, followed by greater China at 30 percent, the company said Thursday. Nike’s North America revenue grew 3 percent in the three months through Feb. 28, showing that Adidas is gaining market share.

Chief Executive Officer Kasper Rorsted has been doubling down on surging sales of casual sneaker lines like the Superstar, originally made popular in the 1980s by rappers Run DMC, to transform Adidas into a fast-fashion business as he seeks to catch up on Nike’s home turf. As of March, Adidas had a roughly 11 percent share of the U.S. athletic footwear market, compared with about 55 percent for Nike, according to Deutsche Bank.

“We need to be humble about where we are in the U.S.,” Rorsted said on a call with reporters. “Our target is to build sustainable brand loyalty. We are coming from a very different basis than our larger competitor.”

Adidas reported first-quarter profit that beat estimates, helped by a strong performance in the U.S., China and online. The shares rose as much as 3.7 percent in morning trading.

Adidas raised its outlook four times last year, providing a springboard for Rorsted after he took the reins from longtime CEO Herbert Hainer in October. The company is betting big on a sportswear fashion trend that has also lifted smaller German sportswear brand Puma as consumers shift away from hard-core providers of athletic gear like Under Armour Inc.

The company plans to invest more in the U.S. and speed up its supply chain to sell more goods at full price. It’s targeting a quadrupling of online sales to 4 billion euros ($4.4 billion) by 2020 and wants to divest its golf hardware and the CCM hockey business as it focuses on its namesake label and the Reebok brand. Online sales advanced 53 percent in the quarter, Adidas said.

Sales at Reebok grew 13 percent in the quarter, driven by strong double-digit sales increases in the “training” and “classics” categories. That was the strongest growth in “many years,” a spokeswoman said, though Rorsted cautioned that gains were unlikely to continue at that rate because the company pulled forward some product launches and opened a disproportionate number of new stores in China in the period.

Adidas’s best-selling shoe in the U.S. was the Superstar, which was third behind two Nike models in the period, according to market researcher NPD Group.

Adidas’s strong performance in the U.S. was not matched in Russia, where the sporting goods market shrank in the quarter as international sanctions and a lower oil price drove consumers to shop for cheaper clothes. The company has closed almost one in 10 of its Russian stores, Rorsted said. While that means Adidas will fall short of its forecast to increase sales in Russia by 10 percent this year, the change has no impact on the group’s overall targets, the executive said.

Overall, earnings before interest and taxes rose 29 percent to 632 million euros, above the 592 million-euro average estimate of analysts compiled by Bloomberg. First-quarter sales rose 19 percent to 5.7 billion euros, beating the 5.4 billion-euro average estimate.

“Today’s earnings release confirms healthy and ongoing brand momentum at Adidas and improvements at Reebok, with growth rates ahead of peers,” RBS analyst Piral Dadhania said in a note, adding that the company’s “market share and margin opportunity in North America is structural and not cyclical.”

Article Retrieved from

https://www.bloomberg.com/news/articles/2017-05-04/adidas-earnings-beat-estimates-on-sales-in-north-america-china

Photo Retrieved from

https://www.bloomberg.com/news/articles/2017-05-04/adidas-earnings-beat-estimates-on-sales-in-north-america-china